Online word of mouth affects bookings: study

A study in the US has revealed that 60 percent of consumers say they factor other travellers’ online reviews into their plans when booking a vacation.

According to the third annual Access America Vacation Confidence Index released by Mondial Assistance USA, with a 10 percent anticipated increase in holiday travel for 2011 -- nearly six in 10 Americans (57 percent) are confident they will take a holiday trip this year -- popular travel review and social media websites can expect more traffic this holiday season.

Daniel Durazo, director of communications for Mondial Assistance, said, “In these tough economic times, consumers want assurance that if they are going to spend on travel, they are selecting the best experiences, and reviews from peers and colleagues act as a security blanket for uncertain travellers.”

Among travellers who share reviews of their travel experiences online (24 percent of respondents), social networking sites such as Facebook are most popular. Nearly one in five (18 percent) say that they share their travel experiences on social networks, more than double the proportion of those who post on travel review sites (eight percent).

As per the findings, travellers under 35 are most likely to say that online travel reviews influence their travel plans (74 percent) while those 55 and over are least likely to be influenced by reviews (44 percent); Nearly 79 percent of respondents with a household income of $75,000 or more factor other travellers' reviews into their own plans, while less than half of those with an income of under $25,000 do so (46 percent).

Nearly two thirds of respondents (63 percent) find other travellers’ reviews to be trustworthy, while 29 percent are less trusting. Travellers under 35 are more likely than those who are older to trust the travel reviews they read (70 percent vs. 54 percent). Over three quarters of respondents with a household income of $75,000 or more (77 percent) find travel reviews to be trustworthy compared to just half of those with an income of under $25,000 (50 percent).

As far as the likelihood of sharing is concerned, adults under 35 are more likely than those who are 35+ to share their travel experiences online (35 percent vs. 20 percent), particularly on social media sites (29 percent vs. six percent). Also, more affluent adults are also more likely to share about their travels. More than a third of those with a household income of $75,000 or more (36 percent) share their travel reviews online, compared to 15 percent of those with a household income of less than $25,000, and they are twice as likely to use social networks to do so (24 percent vs. 12 percent).

Association

Consumers look for genuine reviews by real consumers speaking about their first hand experiences. Consumers are primarily looking for depth and breadth of objective opinion.

In an interview with EyeforTravel’s Ritesh Gupta, conducted a couple of months ago, Gilles Granger, Founder & CEO, Vinivi, shared that consumers look at pictures, and then they look at reviews, typically at four elements:

- Volume: Has this property been rated by more than 10 people?

- Freshness: When were the last reviews written?

- Profile: Do the reviewers match my profile (age, type of traveller), or, if reviewers do not match my profile, are they the kind of travellers I wish to see once there?

- Trust: May I trust the reviews I see? Have they been filtered by the OTA or the website? Did the reviewer really stay there?

According to Nathan Labenz, a co-founder of Stik.com, a startup that helps people do business with professionals that their friends recommend, trustworthy content is a huge part of the association.

“Trust can be established in a couple of ways. The most obvious is to have a website brand that people trust. TripAdvisor has had some recent problems in this regard, but overall I still trust the site and believe that most people are telling the truth,” said Labenz.

He added that another way to establish trust is to build a reputation system within the site to help users know which reviewers other visitors have found helpful.

Openness

Travel companies are now themselves opening avenues and letting consumers post content on their sites.

In a recent interview with EyeforTravel, Richard Anson, founder and CEO, Reevoo, mentioned that travel companies still have a long way to go. There are a number of challenges around how best to generate this social content to give a balanced picture of your business that consumers will trust.

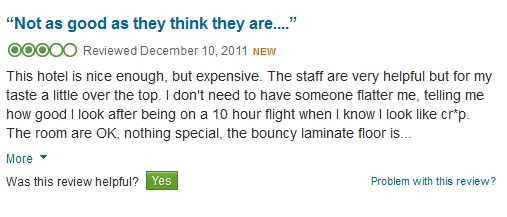

“Most travel companies will be using passive systems where they let members of the public post directly to their site or their Facebook pages. As well as delivering only a handful of reviews, these systems tend to see a disproportionate response from unhappy customers,” Anson told EyeforTravel’s Ritesh Gupta.

The alternative is a proactive system – in which all customers are contacted post-trip to ask for reviews – which leads to a more balanced picture that isn’t dominated by extremely good or extremely bad ratings.

“Trust is also a key factor. Consumers are savvy enough to know that not all social commerce content is equal: research shows that consumers trust reviews sourced and administered by an independent third party three times more than reviews provided by a brand alone. So, travel companies that control their social commerce content themselves will find their return is ultimately limited,” said Anson.

Recommendations from “Connections”

According to Labenz, the next big thing in user-generated content is clearly the use of Facebook-connected reviews and recommendations.

“People are generally very interested to know what their personal friends thought of things, but it goes deeper than that. People assume that what you say in connection with your Facebook account is true because they know that your friends will see it. Even if they don’t know you, they assume that you wouldn’t lie to your friends,” said Labenz.

Making the most of knowledge and experiences about destinations, hotels and any travel-related activity by sourcing recommendations, comments and tips from “friends” or known people is gaining prominence and is also reflecting in what a spate of new travel ventures are promising at this juncture. It is being highlighted that friends and connections can prove to be a better source of inspiration.

Some of the start-ups in the travel sector believe that as the social graph matures and becomes as robust as it has, everyone's becoming very interested in getting more utility and value out of it. With travel being so inherently social, it's a key space to create elegant applications that combine the robust social graph and people's natural desire for travel to be social.

A section of the industry also believes that social shopping is still evolving and there is no clear winning model yet.