US airline consolidation: what happens next?

Regular columnist Tom Bacon argues that when it comes to US airline consolidation, there is more to come

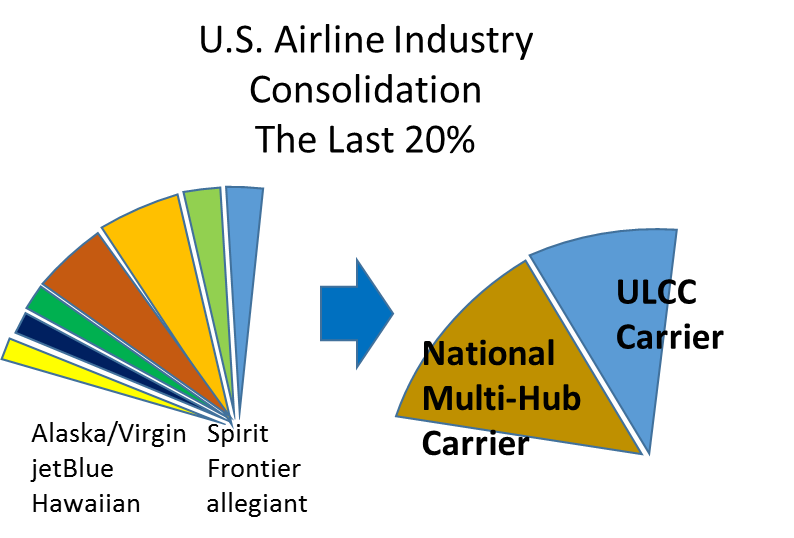

Tremendous consolidation has occurred in the US airline industry in the past decade. And, after the mergers of mega-carriers American Airlines and USAirways, United and Continental Airlines, and Delta-Northwest, we closed 2016 with yet another merger. This one, between Alaska and jetBlue, leaves just ten large US carriers, down from 18 a decade ago. With this merger, the industry is structured as follows:

-

Four carriers with over 80% of domestic capacity:

- Three large, hub-oriented, global legacy carriers (American, United, Delta)

- One large, point-to-point oriented ‘low cost’ carrier (Southwest)

-

Six much smaller carriers, each with less than 5% of the market

- Three smaller, primarily hub-oriented carriers (Alaska, jetBlue, Hawaiian)

- Three much smaller point-to-point travel merchandisers, heavily reliant on ancillary fees, so-called ‘ultra low cost carriers’ or ‘ULCCs’ (Spirit, Frontier, Allegiant)

Most analysts conclude that the four large carriers cannot merge with any of the remaining six carriers for antitrust reasons. The US Department of Justice would intercede, arguing that each is already as large and dominant as it needs to be. Does this mean consolidation is over? Will six small carriers, each continue to get by with less than 5% shares? In ten years, will we still see these same ten US carriers?

Arguably, each of the remaining six smaller carriers has a successful niche. None are financially troubled; all have a strong position in their markets with robust, defensible strategies. They each benefit from ‘capacity discipline’ exercised by the larger carriers, who are cautious about adding capacity ahead of demand. And many are taking advantage of this by growing faster than the market. They each could continue quite successfully if there are no further shocks… Which, of course, is unlikely in this often volatile industry.

Examples of possible shocks

Despite overall capacity discipline, Delta is building a Seattle hub competitive with Alaska and also building up operations in Boston against jetBlue. Delta, United and American have each targeted the ULCC’s with newly announced ‘Basic Economy’ fares. A spike in fuel prices would hurt Allegiant most given its historic reliance on older, less fuel efficient aircraft (they have recently commenced a new strategy with newer airplanes, however). There is little that is constant in this industry.

Rationale for consolidation: location, location, location

One lesson from the Alaska/Virgin merger is that sometimes such deals occur for primarily geographic reasons (‘location, location, location’), triggered by unforeseen externalities. The merger apparently wasn’t the result of detailed analysis of fleet, brand and culture commonality (there was little such commonality!). Alaska purchased Virgin in part due to a bidding war against jetBlue which, it feared, would use Virgin’s presence in California to become a major force there, a market Alaska relies on heavily. This merger is clearly premised primarily on schedule geography – combining a Seattle hub with a San Francisco focus to build strength on the West Coast; none of brand, fleet nor culture is ‘common’.

Further consolidation on the horizon

With similar primarily geographic logic, and potentially driven by similar shocks or reactionary moves, each of the following remain merger opportunities:

Alaska/Virgin; jetBlue; Hawaiian: Now that Alaska/Virgin have merged, jetBlue and Hawaiian represent the remaining hub-oriented airlines with limited geographic diversification. jetBlue would add East Coast presence to the new merged West Coast focused Alaska/Virgin. Hawaiian, on the other hand, would enhance West Coast presence while adding Asia Pacific, something that ultimately could further strengthen Alaska in Seattle against Delta. Based on 2015 revenue, the combination would be $16 billion, or still less than half the size of any of the big three hub carriers.

Spirit, Frontier, Allegiant: The merger of Frontier and Spirit has been previously rumoured given their similarity in business models (ULCC) and fleet commonality; this merger remains a possibility. Allegiant, while quite different from each with respect to their fleet/schedule strategy, may represent a good fit at some point – all of these carriers rely heavily on ancillary fees; all are more focused on point-to-point services rather than mega-hubs. Spirit has announced that much of its future growth will be in smaller markets, more similar to Allegiant’s orientation. Together, these three would represent only 5% of industry revenue based on 2015 results but all are growing faster than the industry. Potentially, a combined ULCC could grow to 10% of the industry.

Although it may take a long time for this to happen, potentially a decade or longer – and new airlines with new business models are likely to appear – some consolidation among the remaining six smaller carriers would hardly damage the big four’s dominant position. The Department of Justice and Department of Transportation, the U.S. regulatory bodies responsible for reviewing mergers, properly imposed limited constraints on the, arguably extremely pro-competitive, Alaska/virgin merger. Hopefully, the government would not limit further mergers among the “little six” should that prove attractive.

Tom Bacon has been in the business for 25 years and is now an industry consultant in revenue optimisation. He leads audit teams for airline commercial activities including revenue management, scheduling and fleet planning. Questions? Email Tom or visit his website