Tips and recommendations to help airlines forecast the unforecastable

Forecasting is a tricky business for any company but Tom Bacon, EyeforTravel regular guest columnist, is here with some useful advice

Consumer products companies, like airlines, regularly develop demand forecasts for thousands of products. Retailers, for example, must forecast not just how many men’s shirts will be purchased but what styles, colours and sizes, and at which locations.

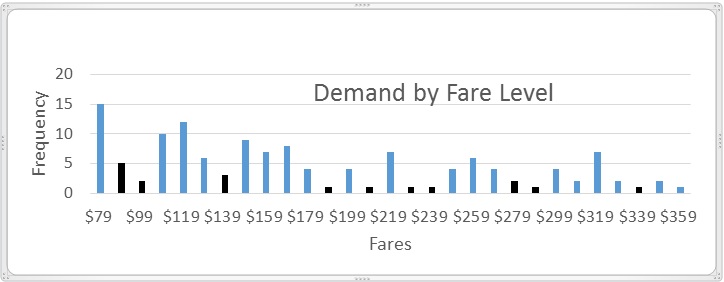

In the case of airlines, we not only forecast demand for each of a thousand or so flights a day for the next year but we often forecast 15 price points and 20 or more Origin & Destination’s (O&Ds) on each flight. The numbers of individual forecasts become mind-blowing.

Demand forecast analysts for consumer product firms speak of certain products being ‘unforecastable’. The analysts are unable to find any identifiable demand pattern based on history; the variance in observed demand overwhelms a single point forecast.

Certainly, for airlines, high fare demand on certain flights can be deemed ‘unforecastable’. Such demand may often be zero but it can be five or ten or more when there is a key business meeting or important conference.

There are two basic methodologies for dealing with unforecastable demand:

1. Aggregation

Demand generally becomes more statistically relevant in larger groupings. Rather than forecast demand for $100 - $120 fare levels, forecasting demand for $100 - $150 may drive a more robust forecast. ‘Leg-based’ forecast systems often treat all connect traffic in aggregate, rather than forecasting each connect O&D separately.

Often we deceive ourselves when we think we are being more precise with a more granular demand forecast; the greater granularity may result in ‘unforecastable’ demand that defies statistical modeling. I worked with one airline that concluded its extremely granular forecasting process was adding significant overall forecast error. The recommendation was to apply some logical aggregation.

Note: RM systems are built on both statistical ‘averages’ and ‘forecast variances’. So, the predictability of demand is implicitly built into the optimisation routines. A large forecast variance for one fare along with a narrow fare discount versus the next higher price point will cause the system to disfavour – and potentially even ignore – the high-variance demand. This is the practical implication of demand being ‘unforecastable’.

2. Exclusion

Group travel for airlines often represents ‘unforecastable’ demand. Since ‘Groups’ represent demand that comes in ‘lumps’, the ‘average’ forecast is meaningless. A group of 25 passengers will need 25 seats, not their probability-weighted average of 3.5. Thus, airlines often separate group demand from their base forecasting processes. Most airlines apply their forecast algorithms to base demand -- excluding groups -- and then add group demand to the base forecast as it actually materialises.

‘Group’ demand blips may be thrown out by some statistical models, as ‘outliers’ that do not fit the historic pattern. However, it is better to identify these demand segments separately and explicitly exclude them from the base forecast.

Prioritising product demand forecasting

To deal with ‘unforecastable’ products, consumer products companies often prioritise their thousands of products. Products with high unit sales are the most important and merit greater attention. Low volume products may be more ‘unforecastable’ but also may not be as critical for planning. Airlines, relying on huge computer models, don’t necessarily do this prioritisation explicitly – they often let their forecast systems apply statistical analysis to all fare levels across all O&D’s. In fact, many airlines pride themselves on the detail with which their RM systems forecast demand. It is important, however, for airlines to become more conscious of the ‘forecastability’ of their products or price points.

Specific recommendations include:

-

Monitor forecast accuracy for their key products. Airlines with O&D RM systems direct most attention to the largest O&Ds (both local and connect). Airlines need to monitor their ability to accurately forecast demand at this level – and periodically adjust their forecast process accordingly.

-

Understand the implication of narrower fare ranges or O&D-level forecasting. Greater granularity does not necessarily drive greater accuracy. Consider aggregation as a means of gaining greater accuracy.

- Separate of ‘lumpy’ demand. ‘Group’ demand is a terrific example of ‘unforecastable’ demand that is generally handled well outside the base forecasting system. There may be other such ‘lumpy’ demand segments in your network that are better separated from the base demand forecast.

Let’s just conclude by saying that ‘unforecastability’ is a term that needs to be added to airline RM lexicons. Airline RM managers too often overstate the value of greater granularity and, consequently, let their RM systems develop forecasts without proper oversight.

This guest post was penned by Tom Bacon, a 25-year airline veteran and industry consultant in revenue optimisation. Email Tom at or visit his website for more useful insights