Bus travel: navigating the potholes in the road

The bus industry is deep crisis right now but with tentative signs of a recovery Marc Hofmann, CEO of metasearch CheckMyBus, remains hopeful of a strong recovery

It goes with saying that demand for bus journeys across the world has hit severe road bumps thanks to the Covid-19 crisis.

Unlike train travel, which is still predominantly state-owned in Europe, bus operators are private companies. In Europe, unsurprisingly, we saw demand fall hardest in Italy first. Starting with a wave of cancellations for chartered buses, regular lines also came to halt in early March. As an example, on the domestic providers front, Flixbus first stopped operations in Italy, then Germany and finally in France.

Due to lockdowns and restrictions of unnecessary travel, demand crashed country by country. First in Europe and then in the United States, schedules were reduced, or operations stopped as companies were quickly burning through money.

Latin America reacted later, notably Brazil and Mexico. Supply and demand stayed available, but now, schedules are being slammed.

With bus companies lacking in core business, many bus providers around the globe became active in their communities, transporting health care professionals, essential goods and even Covid-19 victims.

Companies right now are battling to survive this significant and unparalleled crisis. Despite the essential nature of their services in society, government aid is not available in every country. For example, in the US, bus companies have been excluded from federal funding, causing problems within the industry. The industry is looking for guidance from policymakers, both in cities and government, on what a future may look like.

First light at the end of the tunnel

While the business is still deep in crisis and there is still some way to go, we are starting to see flickers of light on the road ahead.

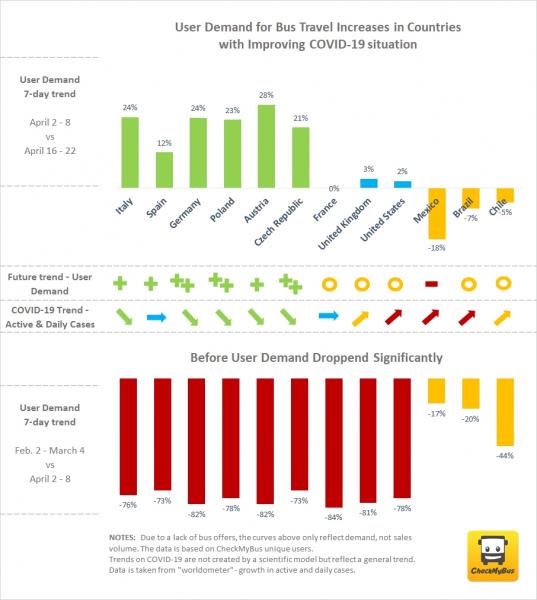

We recently looked at our data to understand user demand curves over a seven-day period trend, when compared with the Covid-19 situation in each country.

What we found is that where the overall Covid-19 situation improves, users begin to search for bus travel and demand increases. Many countries in Europe were struck quite early, and are now witnessing a slow recovery in demand. The same is not true where Covid-19 curves are still rising or the crisis remains at high levels. In Latin America, we see demand beginning to fall as the crisis deepens.

However, the rising demand is not reflected by the number of tickets sold, as there is a lack of supply from many bus companies. As restrictions loosen, and we get a look at operator’s plans, more and more inventory will begin to be made available to the public.

We are not out of the woods yet, but it is encouraging for us to see that demand is rising once the situation becomes more under control.

Future outlook

In difficult times it is always important to have hope. We believe there are reasons for hope and even for opportunity ‘after’ the crisis.

- First roadmaps

Due to decreasing numbers of Covid-19, countries under initial lockdown are beginning to outline the roadmap towards recovery. More and more, exceptions are being made to lock-downs. This is happening at different paces but we are beginning to see the reopening of shops and public transportation in some countries. This loosening of restrictions could lead to more inventory being made available, which could translate into more riders.

- Domestic travel first

While it is very unlikely that unrestricted global travel will be possible in the summer, domestic travel is likely to happen in countries with reasonable Covid-19 reduction rates. Bus is typically strong domestically, which is good news for providers. Although, we don’t have our own data from China our contacts report domestic travel was first to be on the rise.

- Selected cross border traffic

There is strong interest across the EU to reestablish free movement of people, as it is of fundamental value. First countries, such as Austria, are setting the roadmap with their hotels due to open at the end of May. It is a likely case that countries with a similar risk situation and regulations will open borders much earlier – potentially with bilateral agreements first and with those countries with a comparable health situation.

- A new normal for bus travel

At the moment there is a lot of discussion and diversity in regulations about what the future of bus travel could look like. In the US, for example, the American Bus Association (ABA) has launched a task force to work with its members on next steps towards ensuring the health and safety of employees and passengers.

Depending on the country’s specific regulations due to social distancing, the overall capacity of buses is being reduced to between 33% and 50%. We believe that masks, which have proved to have a strong impact on weakening transmission, will play a key role in increasing capacity to 50% and beyond.

- Shared mobility

Just five years ago, 243-billion journeys were made on public transport in 39 countries around the world, and of those 63% were made by bus. In the long term, we believe that bus and train travel are likely to prove increasingly popular as economies recover. Compared to renting a car, this is the more inexpensive option for travellers.

Another factor to consider is how climate change has eased in recent months. As people around the world have looked up to clearer skies, sometimes in the world’s most congested cities, many people want their governments to hold on to this lesson from the corona crisis and think far more seriously about climate change. Against this backdrop, the megatrend remains that shared mobility services like bus travel can and will play a crucial role in solving the challenges of pollution and congestion.

At the same time, as packed bus terminals and bookings made over the counter become less desirable given health concerns, the shift to purchase tickets online will accelerate. Yet today, just 15% of intercity and airport bus travel is bookable online.

With COVID-19 bus travel has hit a pothole in the road but for those that have the capacity and grit to hang in, it remains an opportunity.

All companies are looking for clarity from the policymakers countries and cities about how and when they might reopen for business. Join us for a webinar tomorrow titled London Post Covid-19: Smart Tech and Harnessing Data for the Public Good